Compliance management

Compliance Management

Get Ahead With Regulatory / Standards Compliance with Automated Gap Assessments

Are you struggling to keep up with the regulatory changes in security compliances?

With increased cyber threats, regulators across key sectors of Banking, insurance, and financial services have stepped up their mandatory requirements.

The annual compliance check is now quarterly or monthly.

This requires businesses to move from traditional manual compliance audits to internal continuous compliance management.

Achieve continuous compliance with Seconize Compliance Management

Automated Collection & Management To Reduce Fatigue

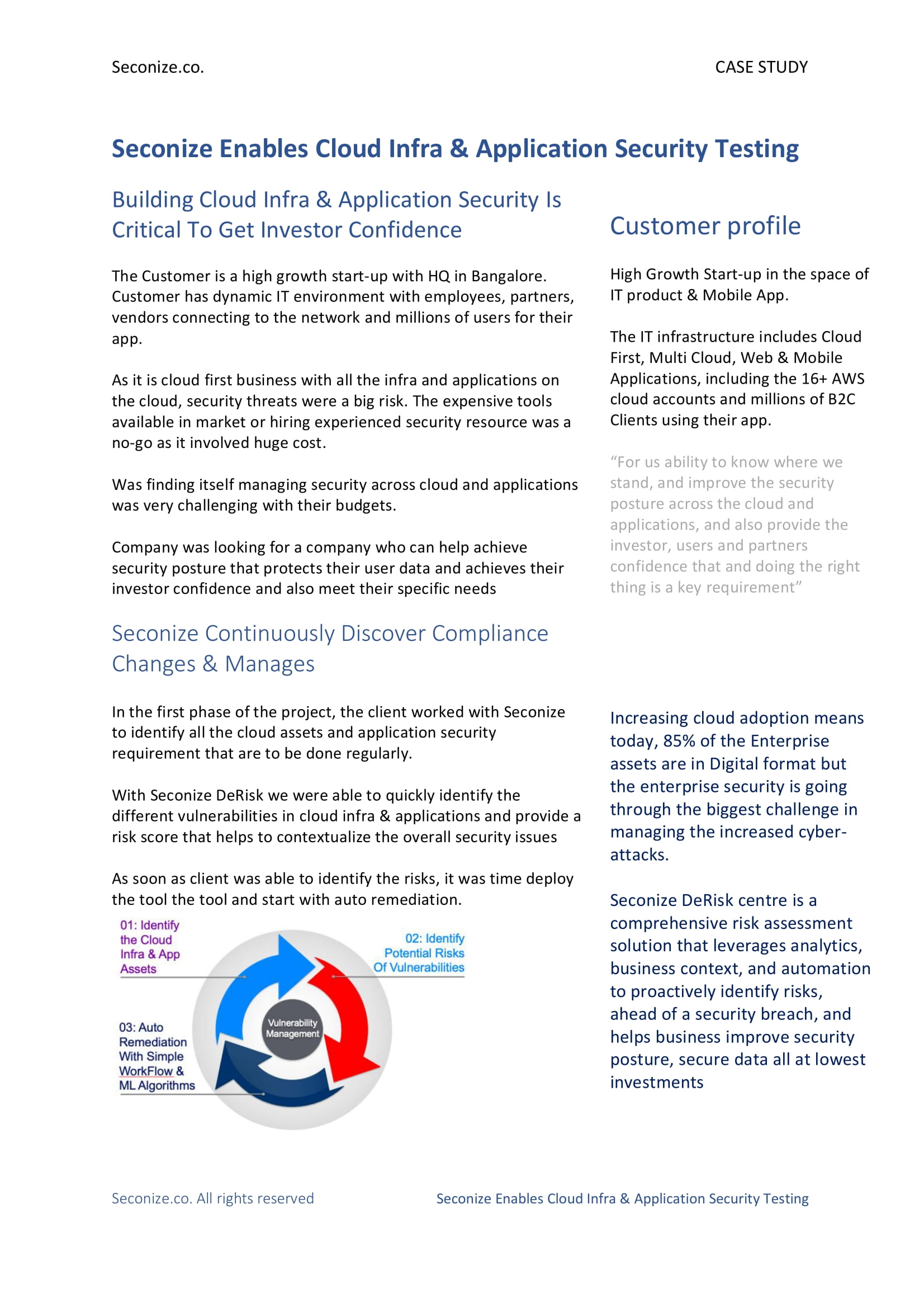

Audit fatigue is a common occurrence across cyber security teams. Infrequent audit leads to severe penalties. With Seconize you can now do automated collection and management of evidence and audits happen continuously.

Identify gaps quickly using custom connectors out of the box

Regulations and standards are continuously being updated. It is key for security teams to understand the latest revisions, identify gaps and comply. Doing this manually is no more feasible. Seconize Technology lets you manage and automatically maps the controls with out of box or custom connectors.

Automated Mapping of 35 regional and global standards

Want to enhance Organization’s maturity across compliances and regulations.

Leverage Seconize's compliance framework which automates the mapping of more than 35 regional and global standards.

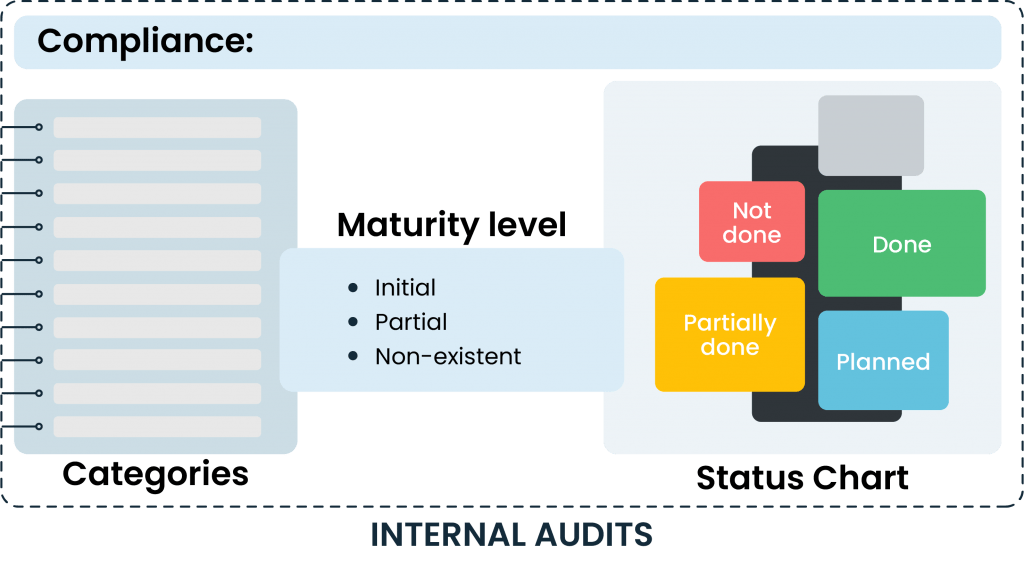

Simplified Workflows to align people and

process related controls for internal audits

Simplified Workflows enable internal audit teams to manage people and process related controls

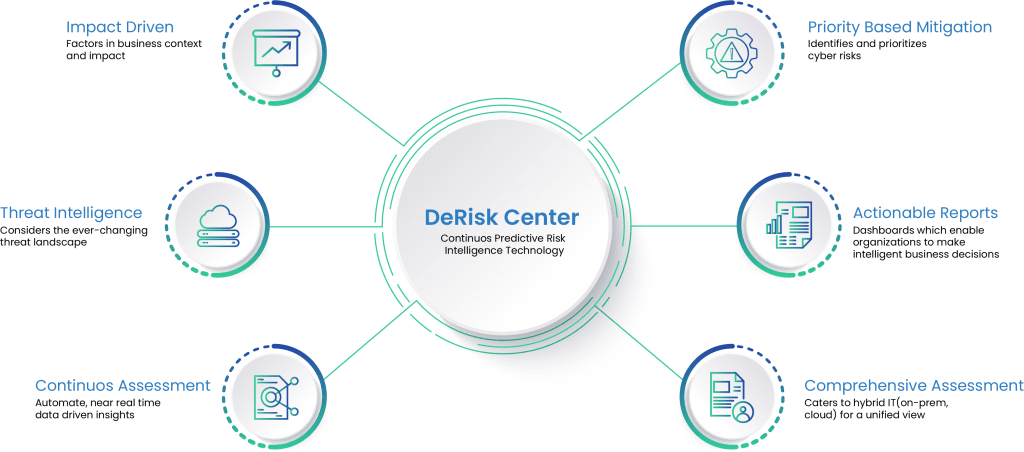

What Makes SMB’s and Enterprises love Seconize DeRisk Center Solution

Testimonials

We had approached Seconize to undertake penetration tests and guide us on any potential security threats. We selected Seconize looking at the relevant security and technology backgrounds of its founders. They had the necessary experience and background to guide us on areas we may not be aware of. Seconize team was highly proactive and enthusiastic.

Enables Fintech SaaS Company To Proactively Meet Compliance Maturity

Customer is a leader in the financial services and fintech space. The key requirement was to assess and improve their security posture across cloud and applications and comply to increasing NBFC regulatory requirements and compliance practices such as ISO 27001, PCI-DSS, and OWASP Top 10.

Copyright © 2024 Seconize Technologies Pvt Ltd. All rights reserved.